Several new regulations came to spotlight with MiFID II regulative, one of them is the requirement to report before the end of a business day if investors portfolio has dropped for more then 10% when compared against the valuation at the beginning of a quarterly reporting period. Or if further 10% depreciation happened within the same period. Even though last such event happened almost a decade ago, this part of the EU regulation is made so that investors get a better glance on information about their portfolio in case any more massive turn on happens.

One of our clients, a company that provides service to pension fund managers, had a legal obligation to implement this type of check and automated report service for their clients.

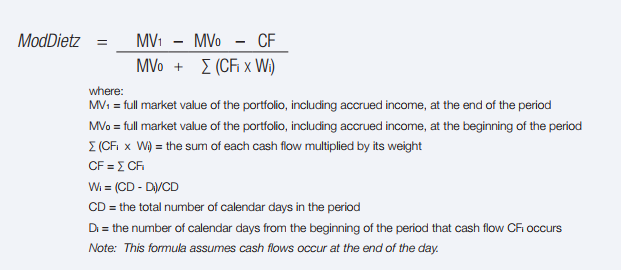

Performance of each investors portfolio was calculated using the Modified Dietz method:

The idea behind using this method is to evaluate a portfolio's performance while taking into the account the timing of contributions or withdrawals from the investor’s portfolio account.

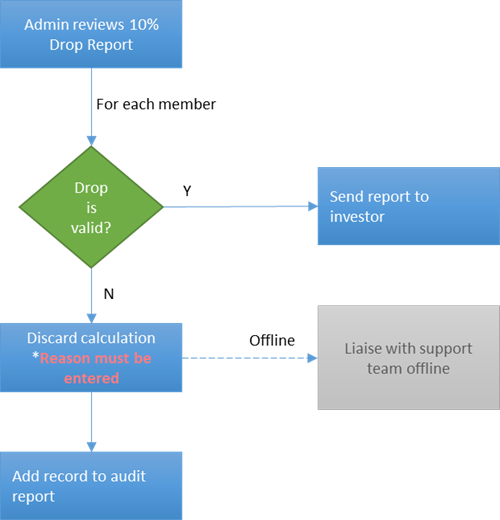

The calculation itself seems as straightforward and simple task but as always some real-life problems may arise. As most important, and the reason for this regulation is overall investors experience and right to be informed on the performance of their portfolio. For our client that also meant it was essential that we don’t have any false alarms. Therefore, one of the requests was to make sure that fund managers will review such cases before the drop is confirmed as valid.

For that purpose, we have added simple notification and review process that notifies fund managers and allow them to review and confirm or reject calculated drops if there is a valid reason. This small add-on to the initial feature was added during the design phase, together with the audit on who reviewed and approved/rejected the drop.

The feature was developed as an independent module that extends our clients admin app. To ensure robustness of the module it was covered by unit and UI coded tests.

With joined effort made from our client’s product owner and our development team, we have quickly developed, tested and upgraded client’s admin application to support the latest EU regulation at mutual satisfaction.

Tags: EU Regulation, Finance, MiFID II, MIRR, Modified Dietz Method